There’s a saying that there’s no such thing as a free lunch, and in my opinion, the $25k Homebuilder Grant could be a trap that many unsuspecting Aussies could fall into.

Before I get into that, let’s run through the Grant that’s on offer:

The HomeBuilder grant offers owner-occupiers (including first home buyers) with a grant of $25,000 to build a new home or substantially renovate an existing home. The contract to do the works must be signed between 4 June 2020 and 31 December 2020 with construction commencing within three months of the contract date. The HomeBuilder grant is payable to eligible applicants in addition to other existing State and Territory first home owner grant programs, stamp duty concessions and other grant schemes, as well as the Commonwealth’s First Home Loan Deposit Scheme and First Home Super Saver Scheme.

To be eligible for the grant, Owner-occupiers must meet the following eligibility criteria:

• you are a natural person (not a company or trust);

• you are aged 18 years or older;

• you are an Australian citizen;

• you meet one of the following two income caps: $125,000 per annum for an individual applicant based on your 2018-19 taxable income or later; or $200,000 per annum for a couple based on both 2018-19 taxable income or later.

• you enter into a building contract between 4 June 2020 and 31 December 2020 to either:

- build a new home as a principal place of residence, where the property value does not exceed $750,000; or

- substantially renovate your existing home as a principal place of residence, where the renovation contract is between $150,000 and $750,000, and where the value of your existing property (house and land) does not exceed $1.5 million (pre-renovation);

• construction must commence on or after 4 June and within three months of the contract date.

So, why do I think this could be a trap?

In both cases of renovation and new build, there is a real risk that people will over-capitalise and end up making a loss which could outweigh the benefit of the $25,000 grant.

Firstly, lets look at it from the renovation element. The limitation on property values of $1.5m pre renovation will discount many properties from being eligible in and around some capital cities (ie Sydney). For those in suburbs where this criteria is met, a spend of $150,000 to $750,000, which coincidently is a LOT of money for people to spend when they are on incomes below the required threshold, could result in a renovated property which is worth less than they have spent…meaning they have gone into negative equity – purely just to get $25,000. Now, this isn’t always the case, but it does mean that extra number crunching needs to be undertaken to be sure this doesn’t happen, especially in such uncertain economic times.

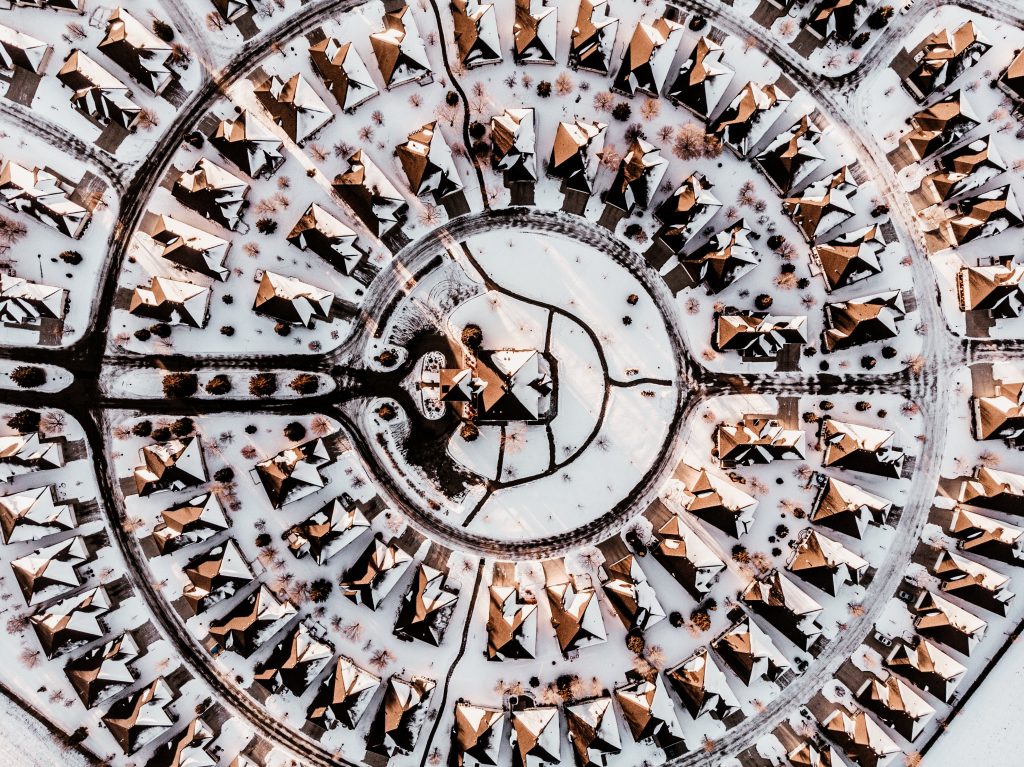

Secondly, this $25,000 grant offers great appeal to first home buyers, especially when you combine it with the other first home buyer initiatives on the table (refer to our article here for a summary). However, when you take into consideration the eligibility criteria and the likely borrowing capacity for the average first home buyer, you are left with a scenario where people are herded towards the typical, mid to outer suburb, house and land packages. We’ve discussed before the importance of resisting the bling of the new build in locations where amenities and infrastructure are sometimes non existent but moreso, how many properties decrease in value in these estates, and at best, have limited upward growth compared to established areas. Consider the suburb of Baldivis – a very popular ‘hotspot’ for new homes in 2015, property values have since dropped 19.3%, leaving many homeowners vulnerable, carrying mortgage stress and in a position of negative equity. (Read Melissa’s story here -> https://www.perthnow.com.au/lifestyle/real-estate/how-the-perth-suburb-of-baldivis-became-australias-bankrupt-capital-ng-b88930844z )

At the end of the day you want to be thinking about what is the value of this going to be at the end and look beyond the free money you are going to be getting from the government,

If you’d like to learn more about getting ahead in property, check out our online course, 10days to Property Prophets. Click here for more -> https://bit.ly/39GMc72